Bond rate of return formula

Calculate the bond yield. To calculate the annual rate of return on a bond divide the bonds interest earned and price appreciation by the bonds value at the beginning of the year.

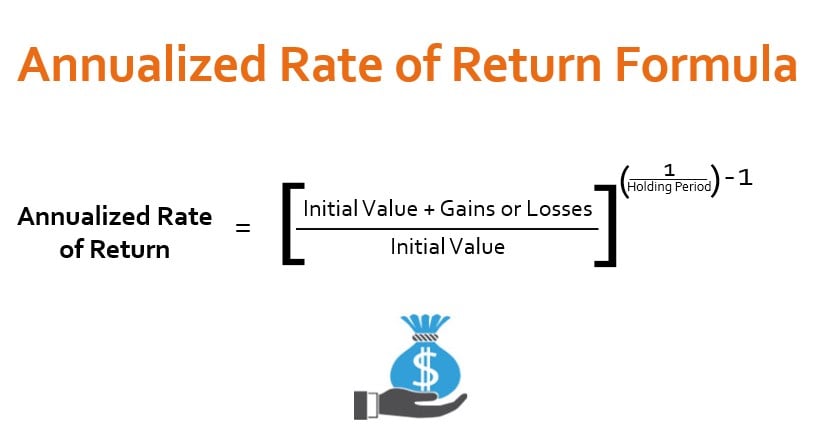

Annualized Rate Of Return Formula Calculator Example Excel Template

Its current yield is.

. 08 or 8. The formula for rate of return is as follows. YTM ie the percentage.

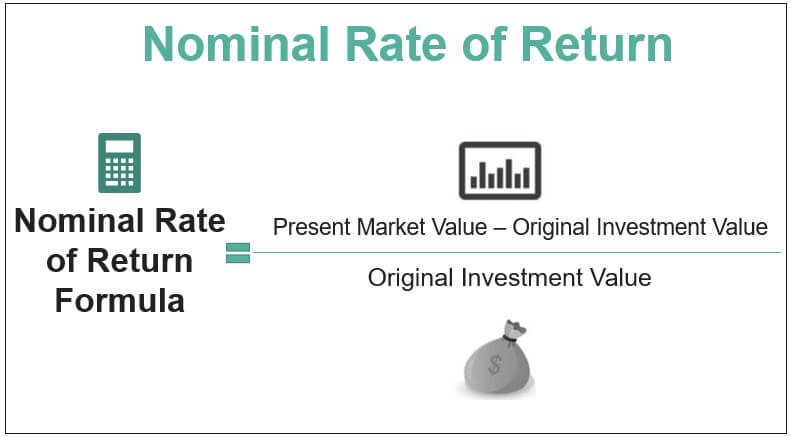

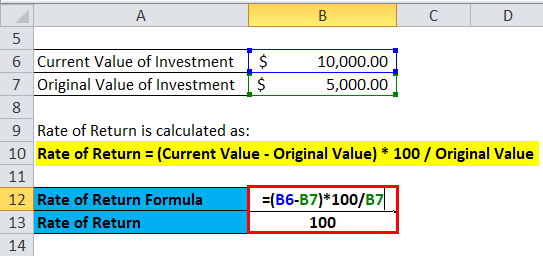

Rate of return Current value of investment Initial value of investment Initial investment value 100. Real Rate of Return Formula 1 Nominal Rate 1 Inflation Rate 1 1 006 1 003 1 106 103 1 00291 291. Price of bond is.

The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at the. IRR internal rate of return t period from 0 to last period -or- 0 initial outlay 1 CF1 1 IRR1 CF2 1 IRR2. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t.

To report it as a the. Yield on bonds is more commonly calculated to the date of maturity. Current Yield 80100.

250 20 200 200 x 100 35 Therefore Adam realized a 35 return on his shares over the two-year period. Interpretation In this formula were first considering. CFX 1 IRRX Using the above examples.

A simple rate of return is calculated by subtracting the initial value of the investment from its current value and then dividing it by the initial value. If youve held a bond over a long period of time you might want to calculate its annual percent return or the percent return divided by the number of years youve held the. The formula for annual return is expressed as the value of the investment at the end of the given period divided by its initial value raised to the number of years reciprocal and then minus one.

Plug all the numbers into the rate of return formula. Calculating the Expected Return The expected return on a bond can be expressed with this formula. The required return of security B can be calculated as Required return for security B 8 100 100 4 The required return for security B 1200 Based on the given information.

The par value of the bond is Rs. Of Years to Maturity On the other hand the term current yield. Composite rate fixed rate 2 x semiannual inflation rate fixed rate x semiannual inflation rate 00000 2 x 00481 00000 x 00481 Composite rate.

A number of funds have earned 4- and 5-star ratings.

Bond Yield Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

Nominal Rate Of Return Definition Formula Examples Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

How To Calculate The Rate Of Return On A Coupon Bond Youtube

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

Yield To Maturity Fixed Income

Current Yield Formula Calculator Examples With Excel Template

How To Calculate The Rate Of Return On A Coupon Bond Youtube

Rate Of Return Formula Calculator Excel Template

Rate Of Return Formula Calculator Excel Template

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Yield To Maturity Ytm Formula And Calculator

Bond Yield Formula Calculator Example With Excel Template

Bond Yield Formula And Calculator

Zero Coupon Bond Value Formula With Calculator

Bond Yield Calculator