Calculate paycheck after 401k contribution

The accuracy or applicability of the tools results to your circumstances is not guaranteed. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

401k

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

. If you contribute that much to your 401 your employer contributes half the amount 1500 of free money as a match. In the following boxes youll need to enter. How are these numbers calculated.

StateLocal Tax Rate. The amount of your current contribution rate how much youre currently contributing to your plan account. This calculator uses the latest withholding schedules rules and rates IRS Publication 15.

Calculate your annual tax by the. Ad Maximize Your Savings With These 401K Contribution Tips From AARP. To determine federal income tax withholding consult IRS Circular E for the.

Below are your federal 401k details and paycheck information. 2022 Federal income tax withholding calculation. Subtracting the value of Withholding Allowances claimed for 2020 this is 4300 multiplied by Withholding Allowances claimed on the employees W.

It is mainly intended for use by US. See the Methodology link below for additional details. This calculator has been updated to use.

So if you make 50000 per year 6 of your salary is 3000. Use our retirement calculator to see how much you might save by the time you retire based on conservative historic investment performance. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

About half of employers who offer a 401k offer this variation. How frequently you are paid by your employer. Note that the tax calculations are based on your overall tax rate.

With sensible diversification elsewhere in your investment portfolio your 401k is an important part of planning for retirement. The total 401 k contribution from you and your employer would therefore be 13000. We encourage you to talk to an investment professional about your situation.

Plan For the Retirement You Want With Tips and Tools From AARP. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Subtract any deductions and payroll taxes from the gross pay to get net pay.

This calculator is provided only as a general self-help tool. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. Annual Gross Salary Total annual salary before any deductions.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary. Ad Learn About 2021 Traditional Contribution Limits.

Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage. Your annual gross salary. Dont want to calculate this by hand.

Please enter or select a. To get a detailed future analysis of your 401k fill out the 401k Future Value Analysis form below. Ad Our 3-Minute Confident Retirement check can help you start finding the answers.

If you increase your contribution to 10 you will contribute 10000. Get started and take the 3-Minute Confident Retirement check to start finding answers. Federal 401k Calculator Results.

For example your employer may pay 050 for every 1 you contribute up to 6 of your salary. This number is the gross pay per pay period. Calculator to determine cost savings realized from a paycard.

Open A Traditional IRA Today. That means your. Your contributions are made after taxes but distributions in retirement are not taxed as income.

Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Federal Income Tax Rate Choose from the dropdown list.

Open A Traditional IRA Today. In 2021 year-to-date earnings is not required or used for incomes under 142800 per year or if your current year-to-date earnings plus your current payroll does not exceed 142800. Pay Period How frequently you are paid by your employer.

Your biweekly 401 k contributions equal 120 leaving 1880 of your salary subject to federal income tax. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. We Go Further Today To Help You Retire Tomorrow.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Second multiply your gross income per pay period by the percentage youve elected to contribute to your Roth 401 plan to determine your 401 plan withholding.

Enroll Now or Increase Contributions. Federal tax withholding calculations. These are contributions that you make before any taxes are withheld from your paycheck.

Ad Learn About 2021 Traditional Contribution Limits. Your expected annual pay increases if any. 401k plans let you invest in mutual funds and index funds growing your.

This tool is not an offer representation or warranty by Nationwide or any of its affiliated companies and does. We Go Further Today To Help You Retire Tomorrow. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

Companies offer this popular option to help employees save for retirement with contributions deducted from each paycheck. The PaycheckCity salary calculator will do the calculating for you. Typically this is your gross earnings minus employer paid health insurance and any Flexible Spending Account FSA contributions.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

1

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

401 K Plan What Is A 401 K And How Does It Work

Microsoft Apps

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Contribution Calculator Step By Step Guide With Examples

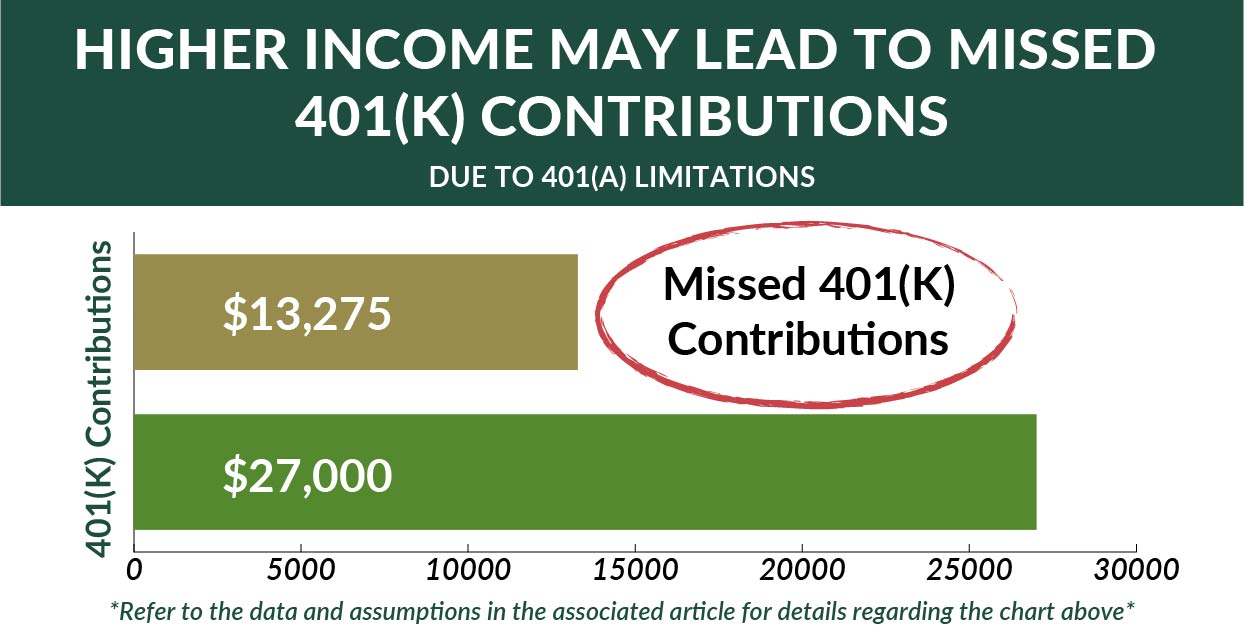

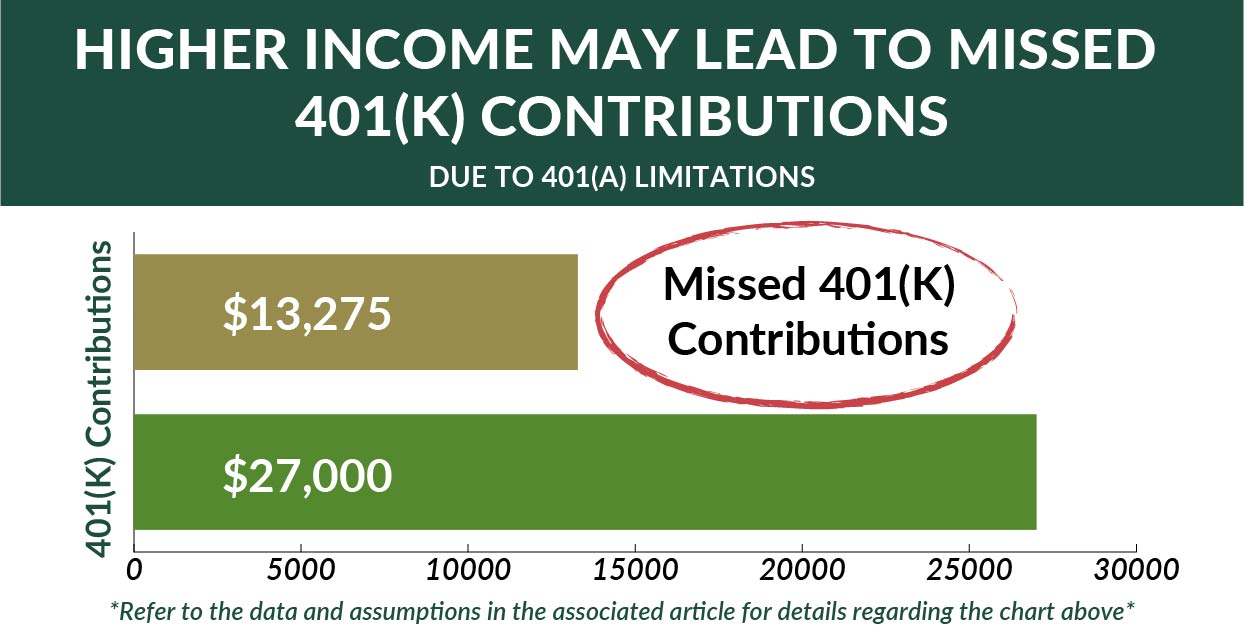

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Solved Double Expense For 401k Payment To Provider

Excel 401 K Value Estimation Youtube

Solved Need 401k Contribution Removed From Bonus Check

After Tax Contributions 2021 Blakely Walters

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

1

What Is A 401 K Match Onplane Financial Advisors

1

401k Contribution Calculator Step By Step Guide With Examples